The post Crypto Liquidation Tsunami: Bitcoin and Ethereum Lead $400M Washout? appeared first on Coinpedia Fintech News

Nothing wakes up traders like red across every chart. Today, the crypto market saw its total capitalization plunge 3.2% to $3.6 trillion. This is with an eye-watering $400 million in crypto liquidations in 24 hours. Bitcoin led the charge downwards, dipping below $107,500 and forcing out over 162,000 long traders, while Ethereum posted almost as heavy losses. Savvy traders turned to stablecoins and Bitcoin for safety.

Wondering what caused the crypto market to go down? As always in crypto, there’s never just one reason.

Top Reasons Behind the Liquidations

Whales and Technicals Fuel the Cascades

Large holders didn’t hesitate. One whale alone moved 13,000 BTC worth $1.48 billion onto exchanges. Then, futures open interest on Ethereum sank by 5.2%. It became a classic liquidation spiral, where falling prices triggered stop losses and even more selling.

Successively, the market cap broke critical support at $3.74 trillion and the 30-day simple moving average. This is while the RSI at 40.88 still left room for more selling, barely above truly oversold.

Altcoins Face the Brunt of Liquidation

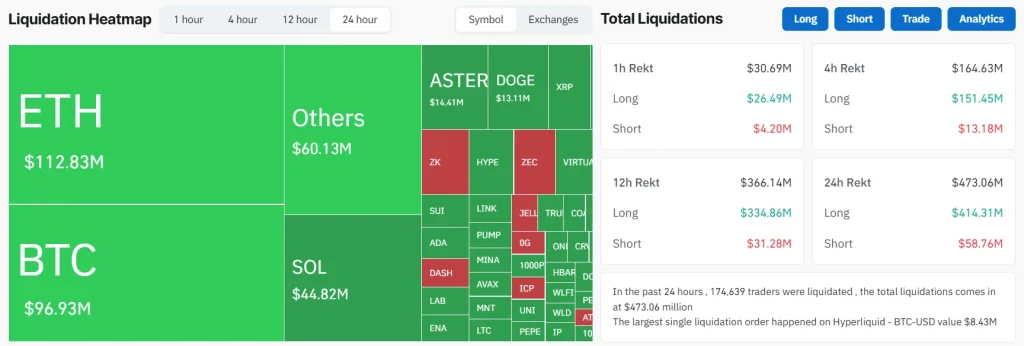

Altcoins fared the worst, which is evident in the crypto liquidations heatmap by CoinGlass. The entire top 50 fell 4% in a day, Bitcoin’s dominance spiked to 60%, and popular tokens like Uniswap and DOGE plunged even further. Ethereum liquidations totaled $112.8 million, just outpacing Bitcoin’s $96.9 million. Solana, ASTER, and DOGE joined the rout, while fear took over social media timelines.

Fed’s Dovish Pause Meets Market Fear

Just days after the Federal Reserve’s October rate hike, Powell walked back hopes for another December cut. That spurred the dollar higher, hitting crypto hard. Markets value lower rates and easier money, so any hint of tighter policy scares off risk-takers fast. Treasury Secretary Scott Bessent also signaled limited room for more easing. The odds of another cut dropped to 69%, and the dominoes fell fast in crypto trading rooms.

ETF Outflows Compound Weakness

Meanwhile, U.S. Bitcoin spot ETFs saw $1.15 billion yanked out last week, especially from industry leaders like BlackRock, ARK Invest, and Fidelity. That kind of pullback signals big investors stepping aside, and warns retail traders about potential further downside. When BTC lost support under $110,000, it was clear the pros were bracing for the worst.

What Do Analysts Have to Say?

“Over $231.7 million in long positions has vanished in 4 hours. Even with US stock futures opening strong, crypto is just free-falling.”

FAQs

It was the perfect storm: Fed policy signals, huge ETF withdrawals, and whale moves sparked cascading liquidations as buyers vanished and prices plummeted.

Ethereum and Bitcoin topped the liquidation charts, but Uniswap and DOGE lost the most in percentage terms, showing traders avoided riskier altcoin bets.

If Bitcoin breaks below $106,000, analysts say the market could face another $6 billion in forced liquidations. Until then, fear rules the sentiment.

The post Crypto Liquidation Tsunami: Bitcoin and Ethereum Lead $400M Washout? appeared first on Coinpedia.org.