Cross-border payments have become increasingly important in the past few years as they have changed business models, technology, and the way money moves around the world. And the market keeps growing. Global cross-border spending was approximately $194.6 trillion in 2024 and is projected to reach $320 trillion by 2032.

This is why we are now looking at the 7 best cryptos for cross-border payments in 2025. And one name stands out in particular – Digitap.

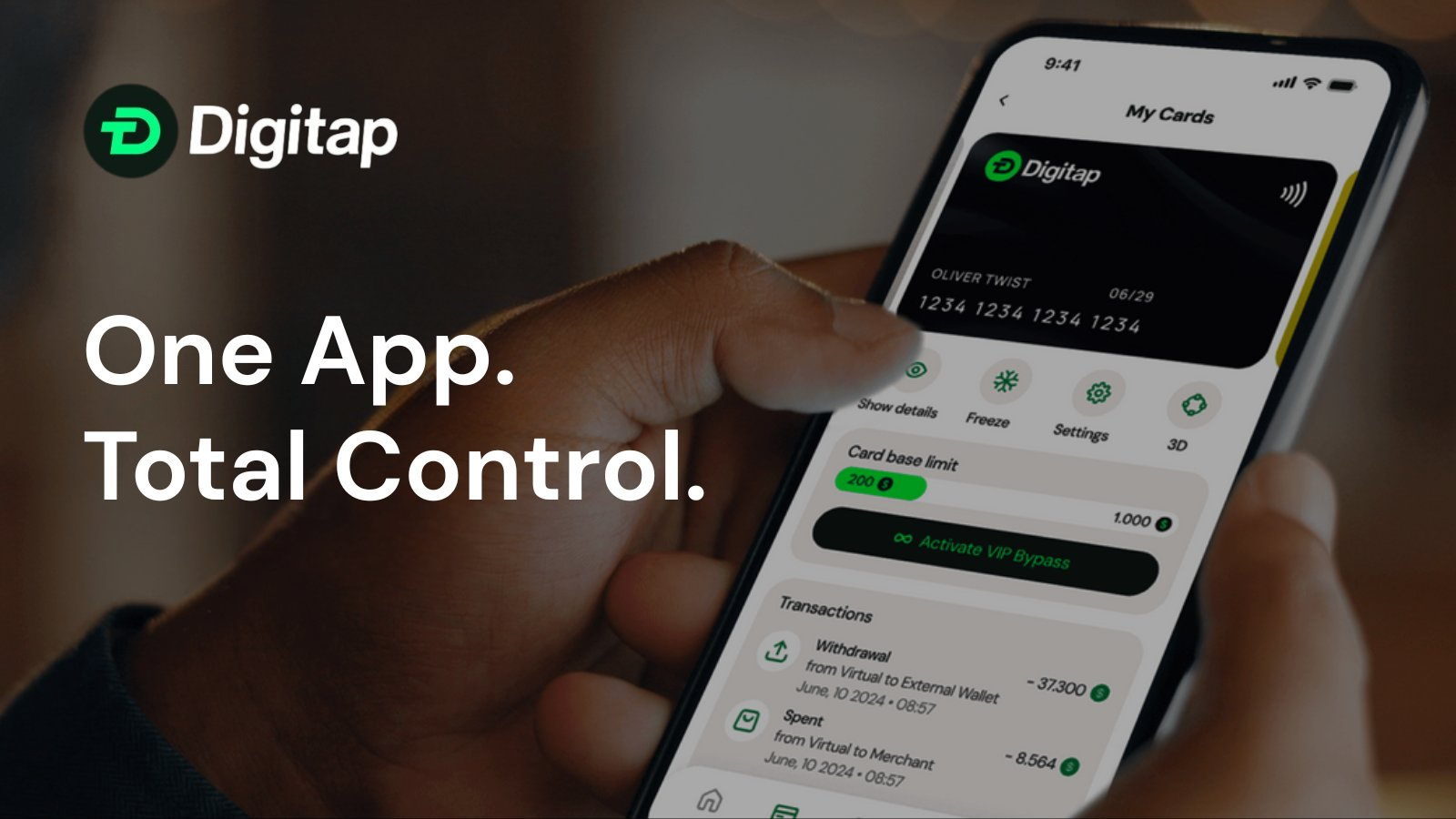

Digitap (TAP) – The New Contender in Global Payments

Digitap is a rising project built to unify crypto and traditional banking into a single, easy-to-use platform. Digitap is made for real people and businesses that need smooth, everyday payments across borders.

At the very heart of the project is its omni-bank app, which combines fiat and crypto balances in one account. Users can hold both dollars and digital tokens without switching apps, and the system’s AI-powered routing chooses the cheapest and fastest path for every transaction. This removes one of the biggest pain points in cross-border transfers: hidden fees and delays.

What makes Digitap even more practical is its direct Apple Pay and Google Pay integration. This means funds can move from a crypto balance to real-world spending instantly. Users can tap their phone and settle payments globally.

This feature makes cross-border settlements as simple as buying coffee at home and this is specifically useful for freelancers, digital nomads, and businesses working with international clients

Digitap also gives users flexibility in how they exit funds. You can send money to bank accounts, cards, external wallets, or even cash pickups. In addition, stealth mode tools help keep spending habits untracked.

On top of that, AI-powered account management helps streamline card, wallet, and account use, making it more user-friendly than traditional banking apps.

The presale numbers are also promising. So far, over 9 million TAP tokens have been sold, and more than $115,000 has been raised, with the token currently priced at $0.0125. The next price increase is already set for $0.0159.

With real-world payments, staking, and reward mechanics at its core, TAP is created to circulate in day-to-day commerce.

Digitap’s utility makes it uniquely suited for cross-border payments in 2025. This new crypto project is building for the end-user experience: fast, cheap, and invisible currency swaps that let you spend globally without worrying about which blockchain is in the background. That real-world utility is why some analysts predict 100x potential once adoption scales.

Ripple (XRP) – The Institutional Standard

Ripple’s XRP has long been a top name in cross-border payments. It works closely with banks and payment providers, offering them fast settlement tools through RippleNet. The On-Demand Liquidity (ODL) solution allows instant transfers between currencies without pre-funded accounts, cutting both time and cost.

In 2025, Ripple is still strong thanks to these institutional connections. It may not focus much on individual users, but XRP serves as a trusted settlement layer for banks moving money across borders.

Stellar (XLM) – Small Payments, Big Reach

Stellar was built to help people send money cheaply, especially in places where banking services are hard to access. Over the years, it has formed partnerships with fintech companies and aid organizations, which makes it useful in regions that depend heavily on remittances.

A typical Stellar transaction costs almost nothing and is confirmed in just a few seconds. That makes it practical for families sending money home or workers making small, frequent transfers. It might not have the scale of Ripple, but it fills an important niche in cross-border payments.

Quant (QNT) – Connecting the Systems

Quant has different goals. It isn’t about being the fastest or cheapest coin, but about connecting blockchains together. Its Overledger system lets banks and companies use different ledgers without worrying about compatibility.

Source: X/@quant_network

For cross-border payments, this is useful because it allows institutions to move assets through whichever chain works best. Users may never see Quant directly, but its role in the background makes global transactions smoother.

Toncoin (TON) – Powered by Telegram

Toncoin became widely popular due to its deep link with Telegram. With hundreds of millions of people already using the app, TON can reach a global audience instantly. Sending Toncoin inside Telegram is quick and feels like a normal chat message.

This makes it attractive for cross-border use, especially for peer-to-peer transfers. Anyone with a Telegram account can use TON without extra steps, which lowers the barrier for international payments.

TRON (TRX) – Stablecoin Highway

TRON has quietly become the main network for stablecoins, especially Tether (USDT). A large share of all USDT transactions worldwide now move through TRON, which shows how central it has become to digital dollar transfers.

For cross-border activity, this matters because many people and businesses prefer using stablecoins over volatile tokens. TRON offers them low fees and fast settlement, which keeps it one of the most practical choices for international transfers.

Cardano (ADA) – Building for Scale

Cardano has been rolling out steady upgrades aimed at making its blockchain faster and more efficient. With Hydra, it can process very large volumes of transactions, which positions ADA well for handling global payments.

It is also built on a proof-of-stake system, which uses less energy than proof-of-work. This makes ADA attractive to companies and governments looking for sustainable options. While Cardano does not have a strong utility as TAP for cross-border payments, its focus on scalability and compliance keeps it in the conversation.

Wrapping Up

To wrap it up, cross-border payments are one of the biggest real-world use cases for blockchain. Ripple, Stellar, Quant, Toncoin, TRON, and Cardano each bring unique strengths.

But in 2025, Digitap looks like the project with the most disruptive potential. Its early presale success, Apple Pay integration, and omni-bank design point to a future where users don’t have to think about “crypto” or “fiat” – they just send, spend, and receive money globally in seconds.

That is the kind of simplicity the $320 trillion cross-border payments market is waiting for.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Social: https://linktr.ee/digitap.app