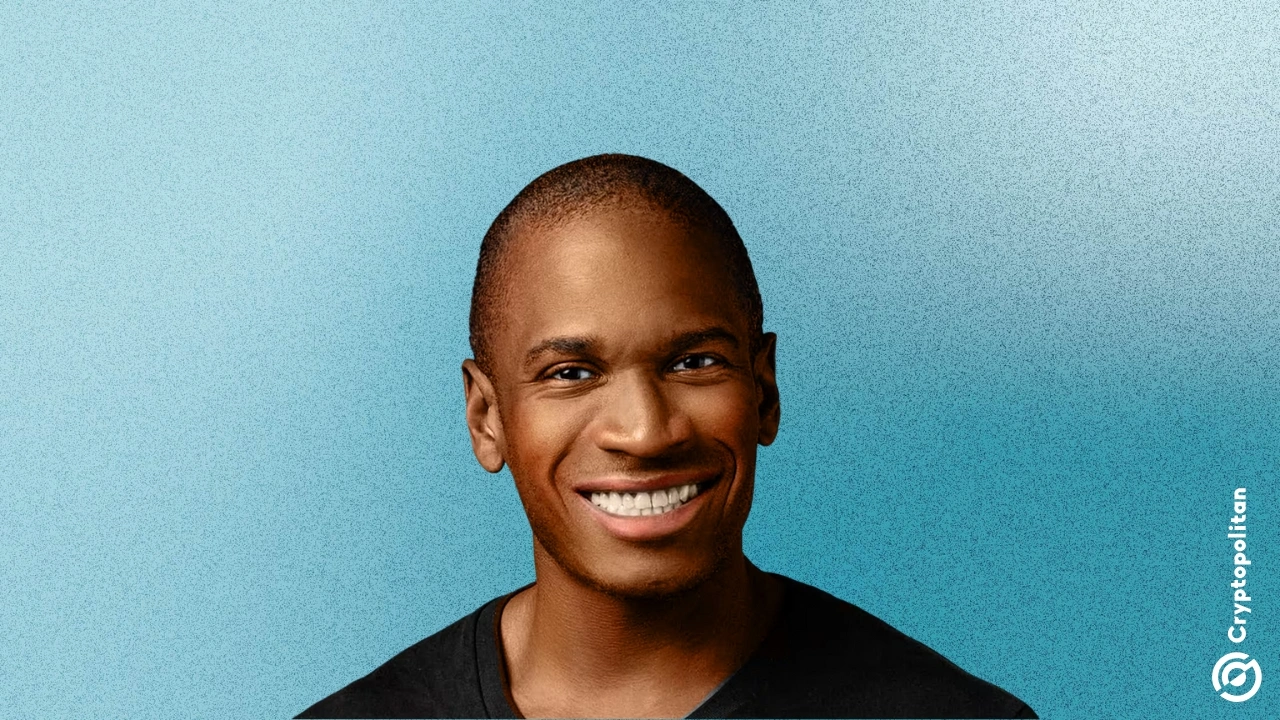

Maelstrom, the family office of Arthur Hayes, is seeking over $250M for the creation of a new private equity fund. If successful, the drive could start a new wave of crypto company acquisitions.

The family office of Arthur Hayes is adding a new private equity capacity, seeking $250M in funding to allocate to crypto acquisition deals. Maelstrom, managed by the family office of Hayes, is seeking to widen its portfolio with deals of $40M to $75M.

The new fund will target medium-sized crypto firms, especially those offering data services or fee-generating platforms. Hayes aims to focus on utility and service firms, including those with developed trading infrastructure or analytics.

The funding is expected to have its first results around March 31, 2026, with the funds fully secured by September.

Arthur Hayes seeks tokenless projects

Crypto VC funding has shifted its priorities and mostly relies on insider funding. External private equity investors have avoided crypto projects since the collapse of the FTX exchange. This year, external private equity have only allocated $1.4B to crypto, down from around $4B in 2021.

The fund’s co-founder, Akshat Vaidya, expects to still raise funds from investors that want exposure to crypto companies. Some of the targeted crypto startups offer high cash flow through fees and significant growth, though Vaidya said funds are often incapable of reaching out to invest in those startups.

The Maelstrom fund will run under the supervision of Vaidya, along with Hayes and newly hired partner Adam Schlegel.

Maelstrom to seek off-chain startups

Maelstrom Equity Fund will be registered as a US entity and will target multiple types of investors. Those may include crypto native investors, pension funds, and family offices.

Maelstrom will build a long-term portfolio, based on infrastructure companies and assets that will be relevant in the usage of decentralized technologies. The fund will back early-stage equity and token investments, as well as public and private market positions, aiming to fund the industry’s next unicorn.

The fund will wrap each acquisition as a special-purpose vehicle, where Maelstrom will be a key investor. The new vehicles will not directly invest in tokens, instead focusing on equity. For that reason, tokenless projects will be highly attractive, as they do not suffer from inflated valuations or market hype.

‘These kinds of businesses are a lot easier to acquire,’ said Vaidya. ‘You can’t artificially inflate valuations with an unused token in the off-chain world. So that’s where we get attractive entry multiples.’

The key feature of the selected companies will be consistent cash flows. Maelstrom will actively manage the company, enhance its management, and accelerate growth, with a sales strategy focused on a 4-5 year time horizon.

Maelstrom’s approach will be unleashed just in time for a series of expected IPOs for crypto companies. The fund also seeks to grab successful analytics and trading platforms, as technological solutions have become more lucrative and sophisticated, while avoiding overly-aggressive token sales.

Recent buyouts include Binance’s acquisition of Gopax, as well as Ripple’s $1B deal for GTreasury.

If you’re reading this, you’re already ahead. Stay there with our newsletter.