The post Crypto Data Reveals Short-Term Investors Are Dumping Bitcoin – Here’s Why appeared first on Coinpedia Fintech News

Bitcoin has been under noticeable selling pressure over the past two weeks. Between April 5 and April 8 alone, the leading cryptocurrency dropped by over 9.01%. As of now, BTC is trading just 2.48% higher than where it started at the beginning of the month. But what’s really driving this dip?

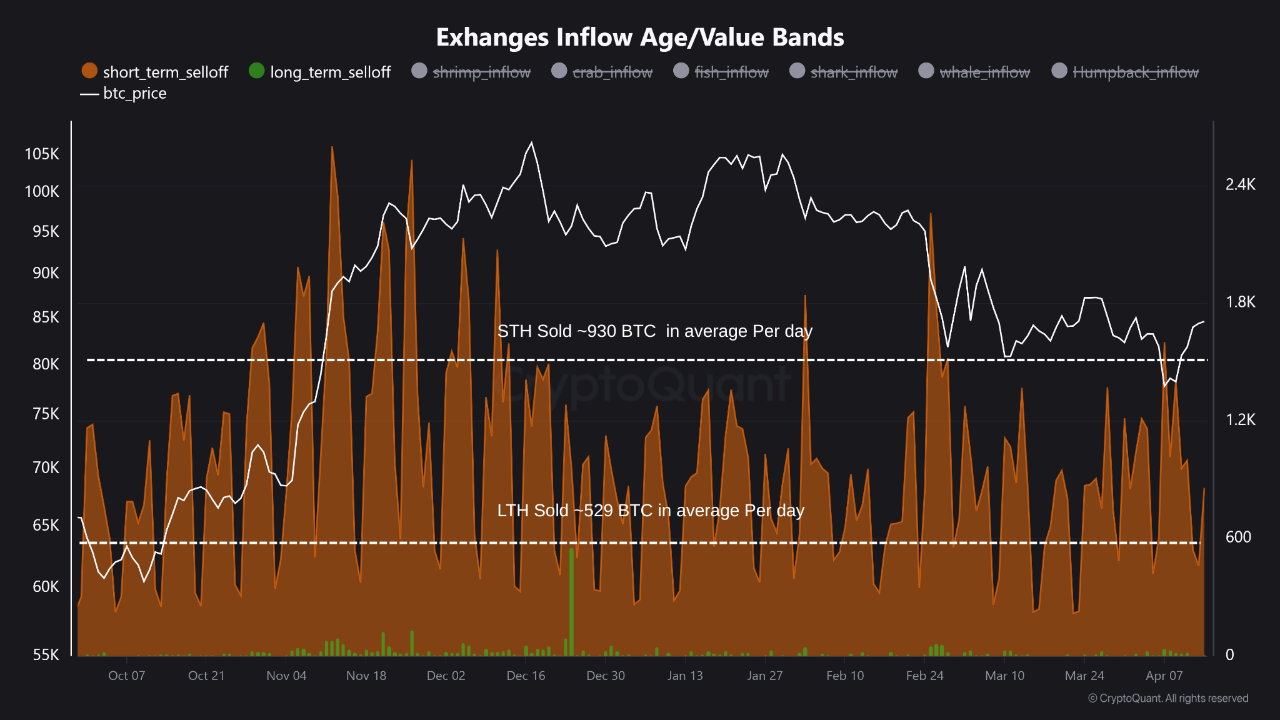

According to on-chain data from CryptoQuant, the primary culprits are short-term holders and smaller wallet groups. Here’s what the data reveals.

Short-Term Holders Are Leading the Sell-Off

A comparative analysis of exchange activity shows a significant gap between short-term and long-term holders. Short-term holders are sending at least 401 more BTC to exchanges daily than their long-term counterparts.

CryptoQuant data indicates that short-term holders offload around 930 BTC to exchanges each day, while long-term holders move only 529 BTC. This suggests that long-term investors remain more confident about Bitcoin’s future, despite recent volatility.

Wallet Cohorts Breakdown: Who Is Selling the Most?

Another layer of analysis breaks down Bitcoin holders into five wallet-size categories: Shrimps, Crabs, Fish, Sharks, and Whales. It turns out the smaller players are showing more concern about BTC’s trajectory compared to the largest investors.

Here’s the breakdown of daily exchange inflows by wallet size:

- Shrimps (<1 BTC): ~480 BTC

- Crabs (1–10 BTC): ~102 BTC

- Fish (10–100 BTC): ~341 BTC

- Sharks (100–1,000 BTC): ~402 BTC

- Whales (>1,000 BTC): ~70 BTC

This behavior highlights a striking trend—while smaller investors are selling off, whales remain largely unfazed. Their minimal activity suggests strong long-term confidence in Bitcoin’s future.

.article-inside-link {

margin-left: 0 !important;

border: 1px solid #0052CC4D;

border-left: 0;

border-right: 0;

padding: 10px 0;

text-align: left;

}

.entry ul.article-inside-link li {

font-size: 14px;

line-height: 21px;

font-weight: 600;

list-style-type: none;

margin-bottom: 0;

display: inline-block;

}

.entry ul.article-inside-link li:last-child {

display: none;

}

- Also Read :

- Crypto Price Prediction 2025: Coinbase Predicts Crypto Rebound by Mid-2025 After Tariff Turmoil

- ,

Is This a Classic Shackout Before the Next Rally?

This selling trend among short-term holders and small wallets appears to be a temporary wave of panic selling before a potential recovery. Whales and long-term holders are not panicking. This suggests that smart money sees strength in the bigger picture. Historically, such shackouts have often preceded strong bullish rebounds in the Bitcoin market.

Despite recent pressure, the Bitcoin market has posted gains of 3.1% over the past week, with a 0.7% increase in the last 24 hours alone. This recovery, although modest, suggests that the worst of the recent dip may be behind us.

Bitcoin Range-Bound but Stable

Since April 12, Bitcoin has been trading within a tight range between $82,711.41 and $86,460.73. At the time of writing, BTC sits at $84,412.

In the near term, volatility may persist as smaller investors continue reacting to uncertainty. However, the lack of significant selling pressure from whales and long-term holders points to underlying market strength. If history is any guide, the current dip could be setting the stage for Bitcoin’s next move upward.

The market may be shaky, but conviction among big players hasn’t cracked—maybe that’s what matters most.

.article_register_shortcode {

padding: 18px 24px;

border-radius: 8px;

display: flex;

align-items: center;

margin: 6px 0 22px;

border: 1px solid #0052CC4D;

background: linear-gradient(90deg, rgba(255, 255, 255, 0.1) 0%, rgba(0, 82, 204, 0.1) 100%);

}

.article_register_shortcode .media-body h5 {

color: #000000;

font-weight: 600;

font-size: 20px;

line-height: 22px;

text-align:left;

}

.article_register_shortcode .media-body h5 span {

color: #0052CC;

}

.article_register_shortcode .media-body p {

font-weight: 400;

font-size: 14px;

line-height: 22px;

color: #171717B2;

margin-top: 4px;

text-align:left;

}

.article_register_shortcode .media-body{

padding-right: 14px;

}

.article_register_shortcode .media-button a {

float: right;

}

.article_register_shortcode .primary-button img{

vertical-align: middle;

width: 20px;

margin: 0;

display: inline-block;

}

@media (min-width: 581px) and (max-width: 991px) {

.article_register_shortcode .media-body p {

margin-bottom: 0;

}

}

@media (max-width: 580px) {

.article_register_shortcode {

display: block;

padding: 20px;

}

.article_register_shortcode img {

max-width: 50px;

}

.article_register_shortcode .media-body h5 {

font-size: 16px;

}

.article_register_shortcode .media-body {

margin-left: 0px;

}

.article_register_shortcode .media-body p {

font-size: 13px;

line-height: 20px;

margin-top: 6px;

margin-bottom: 14px;

}

.article_register_shortcode .media-button a {

float: unset;

}

.article_register_shortcode .secondary-button {

margin-bottom: 0;

}

}

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.