The post Ethereum Whale Sell-off 20,000 ETH, Traders’ Eyes on $2,200 appeared first on Coinpedia Fintech News

Amid ongoing market uncertainty, crypto whales appear uneasy holding assets, as evidenced by their recent actions. On February 14, 2025, blockchain transaction tracker Lookonchain shared a post on X (formerly Twitter) revealing that a giant whale had dumped 20,000 Ethereum (ETH), worth $52.84 million, to the Kraken cryptocurrency exchange.

Whale Dumps 20,000 Ethereum (ETH)

With this dump, the whale currently holds 50,874 ETH worth $134.80 million. However, looking at the post, it appears that this is not the first time this whale has dumped ETH. The most recent dump was noted on January 16, 2025, when Kraken witnessed a sale of 20,000 ETH worth $67.60 million.

In the cryptocurrency market, such a large dump of any asset has the potential to create selling pressure and drive prices lower.

Ether Current Price Momentum

However, Ether’s price appears to be affected, as it is currently down 1.10% in the past 24 hours, trading near the $2,655 level. Data from CoinMarketCap reveals that this substantial dump, along with ongoing market sentiment, seems to be impacting market participants, resulting in a 10% drop in trading volume.

Traders Bearish Positions Skyrockerts

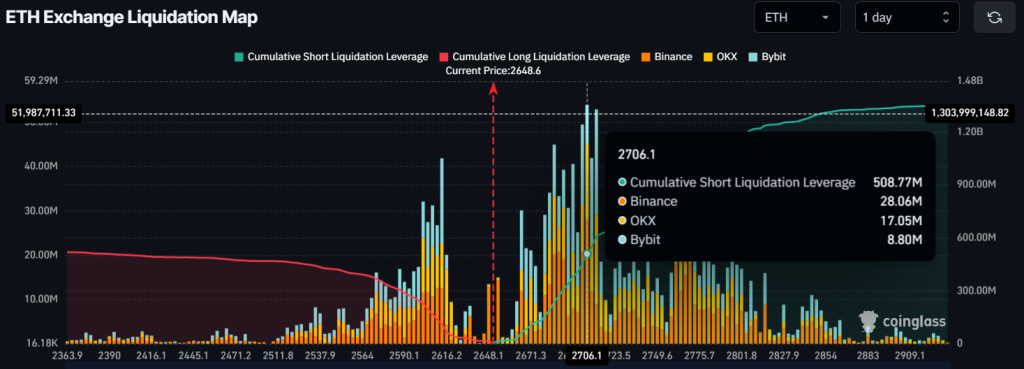

With this bearish outlook, traders are strongly betting on the downside, believing that the price won’t rise in the coming days, as reported by the on-chain analytics firm Coinglass. Data from the ETH exchange liquidation map shows that traders holding short positions are dominating the asset, with over-leveraged positions at the $2,700 level, totaling $510 million.

Meanwhile, traders holding long positions are over-leveraged at the $2,615 level, with $109 million in open positions. These long and short positions will be liquidated once the price moves in either direction.

When combining the whales’ significant dump and traders’ bearish bets, it appears that bears are currently dominating, increasing the likelihood of a significant negative impact on the asset’s price.

.article-inside-link {

margin-left: 0 !important;

border: 1px solid #0052CC4D;

border-left: 0;

border-right: 0;

padding: 10px 0;

text-align: left;

}

.entry ul.article-inside-link li {

font-size: 14px;

line-height: 21px;

font-weight: 600;

list-style-type: none;

margin-bottom: 0;

display: inline-block;

}

.entry ul.article-inside-link li:last-child {

display: none;

}

Ethereum (ETH) Price Action and Upcoming Levels

According to expert technical analysis, ETH is currently consolidating within a tight range at a crucial support level near $2,550.

Based on recent price action, if ETH holds this support, there is a strong possibility that the asset could surge. On the other hand, if ETH fails to hold this level and closes a daily candle below $2,500, it could drop by 10% to reach the $2,220 level in the near future.

.article_register_shortcode {

padding: 18px 24px;

border-radius: 8px;

display: flex;

align-items: center;

margin: 6px 0 22px;

border: 1px solid #0052CC4D;

background: linear-gradient(90deg, rgba(255, 255, 255, 0.1) 0%, rgba(0, 82, 204, 0.1) 100%);

}

.article_register_shortcode .media-body h5 {

color: #000000;

font-weight: 600;

font-size: 20px;

line-height: 22px;

}

.article_register_shortcode .media-body h5 span {

color: #0052CC;

}

.article_register_shortcode .media-body p {

font-weight: 400;

font-size: 14px;

line-height: 22px;

color: #171717B2;

margin-top: 4px;

}

.article_register_shortcode .media-body{

padding-right: 14px;

}

.article_register_shortcode .media-button a {

float: right;

}

.article_register_shortcode .primary-button img{

vertical-align: middle;

}

@media (min-width: 581px) and (max-width: 991px) {

.article_register_shortcode .media-body p {

margin-bottom: 0;

}

}

@media (max-width: 580px) {

.article_register_shortcode {

display: block;

padding: 20px;

}

.article_register_shortcode img {

max-width: 50px;

}

.article_register_shortcode .media-body h5 {

font-size: 16px;

}

.article_register_shortcode .media-body {

margin-left: 0px;

}

.article_register_shortcode .media-body p {

font-size: 13px;

line-height: 20px;

margin-top: 6px;

margin-bottom: 14px;

}

.article_register_shortcode .media-button a {

float: unset;

}

.article_register_shortcode .secondary-button {

margin-bottom: 0;

}

}

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.