Key takeaways

- Ontology might reach as high as $0.1660 by 2025.

- Estimates for ONT’s average price in 2028 range from $0.4620 to $0.5563.

- Ontology’s average price in 2031 will be $1.47, with a maximum price of $1.69.

Ontology (ONT) is a blockchain project launched in 2017 by Li Jun to deliver Peer-to-peer (P2P) identity and data solutions for Web3. Ontology skipped the ICO model and distributed tokens through community airdrops and building adoption. Its MainNet went live in June 2018, powering Independent applications, identity protocols, and enterprise-focused blockchain solutions. The network supports multiple virtual machines (Ontology EVM, NeoVM, WasmVM), giving developers cross-chain compatibility and flexibility. Tools like ONT ID, ONT Login, and the ONTO Wallet enhance user privacy, authentication, and easy access across chains.

In terms of performance, Ontology reached an all-time high of $11.18 (May 2018) and an all-time low of $0.1058 (June 2025). These price points guide technical analysis, candlestick charts, and help traders predict future ontology price movements based on support and resistance levels. Ontology’s tokenomics include a maximum supply of 1 billion ONT, with nearly 80% already in circulation, distributed among the core team, NEO council, partners, and community development.

With its focus on identity, interoperability, and enterprise adoption, Ontology remains a key player in the crypto market. For ontology traders and investors, tracking the price chart, moving averages, and relative strength index (RSI) is crucial for forecasting potential ROI and evaluating whether Ontology is a good long-term investment. Explore our Ontology price prediction from 2025 to 2031 and an in-depth analysis of anticipated ONT price movements, expected price range, and technical indicators.

Overview

| Cryptocurrency | Ontology |

| Abbreviation | ONT |

| Current Price | $0.1382 |

| Market Cap | $124.21M |

| Trading Volume | $7.66M |

| Circulating Supply | 914.69M ONT |

| All-time High | $11.18 (May 02, 2018) |

| All-time Low | $0.1058 (Jun 22, 2025) |

| 24-hour High | $0.1395 |

| 24-hour Low | $0.1342 |

Ontology price prediction: Technical analysis

| Metric | Value |

| Volatility (30-day Variation) | 9.53% |

| 50-Day SMA | $0.144316 |

| 200-Day SMA | $0.145952 |

| Sentiment | Bearish |

| Fear & Greed | 51 (Neutral) |

| Green Days | 13/30 (43%) |

Ontology price analysis

TL;DR Breakdown

- Ontology price analysis shows bullish pressure, trading at $0.1382.

- The coin gained 1.85% in the last 24 hours.

- ONT faces resistance near $0.150, with strong support around $0.135.

On September 8, 2025, Ontology price analysis shows a moderate bullish trend as the ontology traded up to $0.1382, marking a 1.85 per cent gain from yesterday’s close at $0.1355 after briefly dipping to $0.1346. Despite today’s slight recovery, ONT has struggled to break above the $0.150 resistance level, and recent corrections highlight that selling pressure remains active around higher price points.

Ontology 1-day price chart analysis

The one-day Ontology price chart confirms a consolidation phase after a decline from the late-August peak. ONT is currently trading at $0.1382, up from yesterday’s $0.1355. A green candlestick reflects modest buying interest, but overall momentum remains weak. Volatility remains moderate, with the price oscillating between $0.128 support and $0.150 resistance. If buyers build momentum above $0.150, the next target lies around $0.180, while a breakdown below $0.135 could drag ONT back toward $0.120.The RSI indicator is currently at 46.07, just below the neutral line.

This suggests indecision, though a slight upward tilt indicates some accumulation from buyers. The MACD remains in the negative zone but is showing flattening histogram bars, suggesting bearish momentum is weakening. A potential bullish crossover could appear if buying interest sustains above the $0.135 mark.

Ontology 4-hour chart

The 4-hour Ontology (ONT/USDT) chart shows the price holding at $0.1386, with movement relatively muted after the recent downtrend. Buyers have managed to provide some stability, but momentum remains cautious. The RSI (14) is currently at 55.93, trending above the neutral 50 line. This indicates that short-term sentiment has turned slightly bullish, with buyers gaining ground after a prolonged bearish phase. This suggests buyers are building strength, though it is not yet in overbought territory.

The MACD line is at 0.0006, the signal line is at -0.0004, and the histogram is at -0.0010. This configuration reflects a recent bullish crossover, as the MACD line has moved above the signal line. The histogram is beginning to turn positive, signaling early recovery momentum. If this crossover sustains, it could encourage further upward price action in the near term. Volatility remains relatively low, but the narrowing range indicates that traders are preparing for the next decisive move.

Ontology technical indicators: Levels and action

Daily simple moving average

| Period | Value ($) | Action |

| SMA 3 | $0.14586 | SELL |

| SMA 5 | $0.143144 | SELL |

| SMA 10 | $0.141887 | SELL |

| SMA 21 | $0.147089 | SELL |

| SMA 50 | $0.144316 | SELL |

| SMA 100 | $0.137455 | SELL |

| SMA 200 | $0.145952 | SELL |

Daily exponential moving average

| Period | Value ($) | Action |

| EMA 3 | $0.144656 | SELL |

| EMA 5 | $0.148377 | SELL |

| EMA 10 | $0.150914 | SELL |

| EMA 21 | $0.148947 | SELL |

| EMA 50 | $0.144656 | SELL |

| EMA 100 | $0.144092 | SELL |

| EMA 200 | $0.154368 | SELL |

What to expect from the next Ontology price analysis?

Ontology’s price action suggests the market is in a consolidation phase, with indicators hinting at a possible shift in momentum. On the daily chart, the price is stabilising above the $0.135 support zone, while on the 4-hour chart, the RSI has climbed to 55.93, signalling strengthening buyer interest. The MACD has also formed a bullish crossover, which often precedes short-term recoveries. If buyers maintain control, ONT could retest the $0.150 resistance level in the coming sessions. A decisive break above this barrier would open the path toward the $0.160–$0.165 zone. However, if bullish momentum fades and ONT loses support at $0.135, the price may revisit $0.130–$0.128, extending the

Is Ontology a good investment?

Ontology (ONT) could be a good investment for those who believe in its focus on decentralised identity (DID) and data privacy solutions, as it offers strong utility for businesses and individuals. The project has potential due to its real-world applications, partnerships, and efforts toward ecosystem growth. However, ONT, like other cryptocurrencies, is highly volatile and influenced by market sentiment, adoption, and regulatory risks. While it may show promise, it’s essential to assess its price trends, competition, and your own risk tolerance before investing. Always diversify your portfolio and conduct thorough research beforehand.

Will ONT reach $1?

Yes, Ontology is expected to reach $1. Projections for 2030 suggest ONT could reach up to $1.01.

Will ONT reach $10?

ONT’s ATH is $11.18; reaching $10 seems achievable, but not soon.

Will ONT reach $100?

Reaching $100 for Ontology would be an extremely ambitious and unlikely target under current market conditions and technological adoption rates.

Does ONT have a good long-term future?

Ontology (ONT) faces significant challenges in achieving substantial long-term growth, especially given the ambitious targets for prices like $10. While there is potential for moderate growth if the project gains adoption and market conditions improve, the steep increase required to reach such high targets suggests that ONT’s long-term future may be uncertain and highly dependent on significant developments and broader market trends.

Recent news/opinion on ONT

QuickEx has officially listed Ontology ($ONT), bringing P2P identity, reputation, and secure communication to its platform. Users can now swap $ONT instantly on QuickEx with no KYC, no registration, and the best rates.

Ontology price prediction September 2025

As for September 2025, the Ontology price is expected to reach a minimum price value of $0.1306. The ONT price could reach a maximum price of $0.1469, with the average price around $0.1428 next week.

| Month | Potential Low | Average Price | Potential High |

| September 2025 | $0.1306 | $0.1428 | $0.1469 |

Ontology price prediction 2025

In 2025, the price of Ontology is predicted to reach a minimum level of $0.1492. The ONT price can reach a maximum level of $0.1660, with the average trading price of $0.1560.

| Month | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2025 | $0.1492 | $0.1560 | $0.1660 |

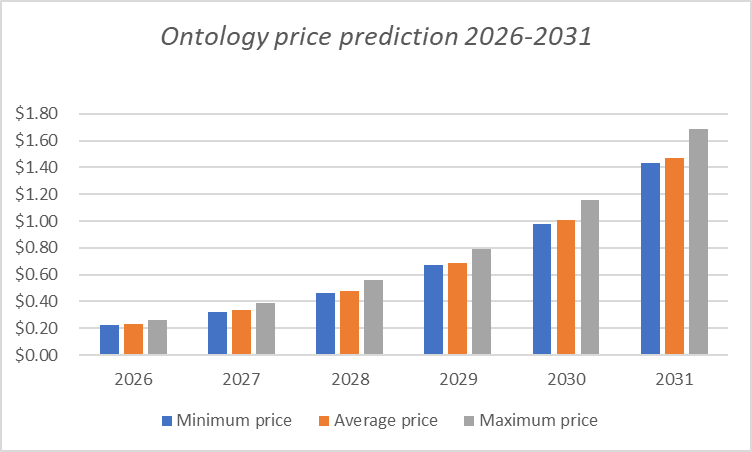

Ontology price predictions for 2026-2031

| Year | Minimum price | Average price | Maximum price |

| 2026 | $0.2249 | $0.2311 | $0.2602 |

| 2027 | $0.3234 | $0.3327 | $0.3887 |

| 2028 | $0.4620 | $0.4786 | $0.5563 |

| 2029 | $0.6696 | $0.6887 | $0.7906 |

| 2030 | $0.9761 | $1.01 | $1.16 |

| 2031 | $1.43 | $1.47 | $1.69 |

Ontology price prediction 2026

ontology network price is forecast to reach a lowest possible level of $0.2249 in 2026. As per our findings, the ontology rise to a maximum possible level of $0.2602 with the average forecast price of $0.2311.

Ontology price prediction 2027

The price of ont is predicted to reach a lower end value of $0.3234 in 2027. The Ontology price could reach a maximum value of $0.3887 with the average trading price of $0.3327 throughout 2027.

Ontology ONT price prediction 2028

In 2028, the price of Ontology is forecasted to be at around a minimum value of $0.4620. The Ontology price value can reach a maximum of $0.5563, with the average trading value of $0.4786 in USD.

Ontology price prediction 2029

In 2029, the ontology prediction is expected to reach a minimum price value of $0.6696 according to technical analysis. The ONT price can reach a maximum price value of $0.7906, with the average value of $0.6887.

Ontology price prediction 2030

The price of Ontology is predicted to reach a minimum value of $0.9761 in 2030. The Ontology price could reach a maximum value of $1.16 with the average trading price of $1.01 throughout 2030.

Ontology price prediction 2031

Ontology price is forecast to reach a lowest possible level of $1.43 in 2031. As per our findings, the ONT price could reach a maximum possible level of $1.69, with the average forecast price of $1.4

Ontology market price prediction: Analysts’ ONT price forecast

| Firm Name | 2025 | 2026 |

| DigitalCoinPrice | $0.1515 | $0.1660 |

| Wallet Investor | $0.048134 | $ 0.156961 |

| Coincodex | $ 0.148565 | $ 0.179554 |

Cryptopolitan’s Ontology price prediction

Our predictions show that ONT will trade between $0.3876 and $0.4415 by the end of 2025. In 2027, Ontology’s market price will range between $0.8411 and $1.02. In 2031, ONT will range between $3.51 and $4.35, with an average price of $3.64. We kindly remind this is not investment advice. Always do your own research on the ont market before you invest money

Ontology historic price sentiment

- Ontology launched in 2017 via airdrops, peaking at $11.18 in May 2018 before a sharp decline. By 2019, it settled between $1.21 and $1.84 after initial highs.

- The price ranged from $0.204 to $2.96, spiking during the 2021 bull run before dropping again.

- Since 2022, the price has stayed low, hovering near $0.26 by late 2024.

- In January 2025, Ontology opened trading at $0.2293 and currently trades between $0.2239 and $0.2524.

- In February 2025, the price slipped further, ranging from $0.1921 to $0.2134.

- In March 2025, ONT moved between $0.1742 and $0.2018.

- In April 2025, the coin declined again, trading between $0.1607 and $0.1855.

- In May 2025, Ontology ranged from $0.1422 to $0.1764 before dropping sharply at the month’s end.

- In June 2025, the token hit its all-time low of $0.1058 on June 22, with a monthly range of $0.1086 to $0.1439.

- In July 2025, ONT rebounded slightly, trading between $0.1237 and $0.1575.

- In August 2025, the price fluctuated between $0.1324 and $0.1918.

- In September 2025 so far, Ontology trades between $0.1342 and $0.1469, averaging near $0.136.