Key takeaways

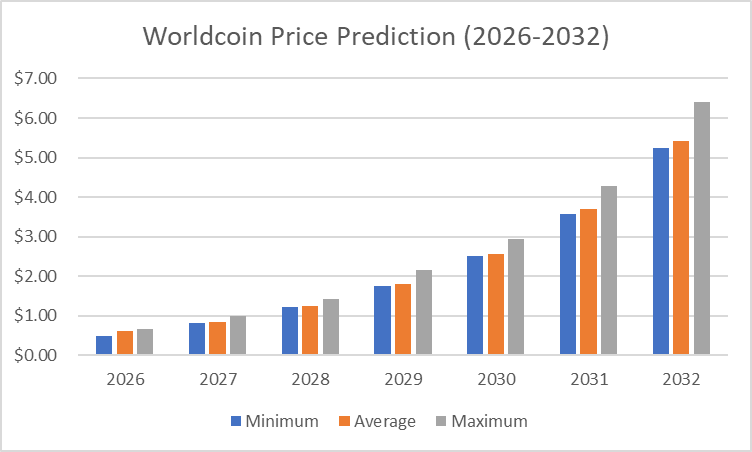

- In 2026, Worldcoin might reach a maximum price value of $0.6686 and an average value of $0.612

- By 2029, the minimum WLD price is expected to drop to $1.74, while its maximum could reach $2.15.

- The price of Worldcoin is expected to reach a maximum level of $6.40 in 2032.

Worldcoin (WLD) is garnering significant attention from both investors and enthusiasts, which may indicate its future performance and current price, a trend that aligns with broader market predictions. In early May, WLD experienced a notable surge, quickly positioning itself among the top-performing altcoins. This rise coincided with a spike in activity surrounding advancements in artificial intelligence (AI), particularly those related to OpenAI. The increased interest in Worldcoin is likely fueled by speculation surrounding potential collaborations and future projects that could integrate AI technology into the cryptocurrency space, further driving its market momentum.

Overview

| Cryptocurrency | Worldcoin |

| Token | WLD |

| Price | $0.3919 |

| Market Cap | $1.13B |

| Trading Volume (24-hour) | $141.76M |

| Circulating Supply | 2.78B WLD |

| All-time High | $11.82 Mar 09, 2024 |

| All-time Low | Feb 06, 2026 $0.314 |

| 24-hour High | $0.4342 |

| 24-hour Low | $0.3903 |

Worldcoin price prediction: Technical analysis

| Metric | Value |

| Price Prediction | $0.2765 (-25.45%) |

| Price Volatility | 8.53% |

| 50-Day SMA | $0.4743 |

| 14-Day RSI | 44.57 |

| Sentiment | Bearish |

| Fear & Greed Index | 5 (extreme fear) |

| Green Days | 12/30 (40%) |

Worldcoin price analysis

- Today, Worldcoin (WLD) is down by 5.11% to $0.3919 in the last 24 hours, continuing its decline after a recent rise.

- The current resistance for WLD is around $0.3920, with support forming near $0.3894.

- Momentum is neutral with the RSI at 44.32, and MACD shows bearish pressure, showing potential downside.

As of February 26, 2026, Worldcoin is trading at $0.3919, showing a 5.11% decline after a minor pullback. The price opened at $0.4131, reached a high of $0.4155, dropped to a low of $0.3894, and closed at $0.3919, marking a 5.11% decrease in the last 24 hours as the selling pressure gained momentum following a recent price rise.

Worldcoin 1-day price chart

Analyzing the Worldcoin 1-day price chart, Worldcoin has been on a downward trend by 5.11%, reaching a price of $0.3919, which is near its support level. This drop follows a pullback from recent highs, which reflects the general weakness in the market. Trading volume has increased by 20.29%, implying that the sell-off is being driven by increased trading activities than usual as the market responds to sector-wide pressure.

RSI is currently at 44.32, indicating neutral momentum, with the market not yet overbought or oversold. The RSI shows that the market remains balanced, with neither buyers nor sellers taking full control.

The MACD shows bearish momentum, with the MACD line at 0.0052, the signal line at -0.0149, and the histogram at -0.0202, suggesting the continuation of downward pressure as the histogram remains negative.

The immediate resistance is $0.3920, a recent high, while support is found at $0.3894, the lower boundary of the price action in the last 24 hours.

Worldcoin 4-hour price chart

On the 4-hour chart is currently trading at $0.3926, down from a high of $0.4008. The price has been fluctuating between $0.3894 and $0.4008, suggesting some short-term consolidation after recent movement.

The RSI is at 49.43, indicating a neutral to slightly bullish market. The price is moving away from the oversold zone and approaching a more balanced range. There is still room before reaching the overbought level of 70, which suggests potential for continued upward movement if buying momentum strengthens.

The Moving Average Convergence Divergence shows a positive trend, with the MACD line at 0.00059 and the signal line at 0.0054. The histogram at 0.0005 suggests the bulls have some control, but the momentum is still weak.

Immediate Resistance is at $0.4008. If the price breaks above this level, further bullish momentum could push the price toward the next resistance level. The Support is at $0.3744. If the price drops below this level, a stronger bearish trend may emerge.

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $0.4761 | SELL |

| SMA 5 | $0.4230 | SELL |

| SMA 10 | $0.3972 | SELL |

| SMA 21 | $0.3936 | SELL |

| SMA 50 | $0.4743 | SELL |

| SMA 100 | $0.5379 | SELL |

| SMA 200 | $0.7582 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $0.4217 | BUY |

| EMA 5 | $0.4541 | SELL |

| EMA 10 | $0.4927 | SELL |

| EMA 21 | $0.5173 | SELL |

| EMA 50 | $0.5784 | SELL |

| EMA 100 | $0.6988 | SELL |

| EMA 200 | $0.8755 | SELL |

What can you expect from the Worldcoin price next?

In the next Pi analysis, it’s expected that if Worldcoin breaks above the immediate resistance at $0.3920, it could rally toward $0.4008, with bullish momentum gaining strength. However, a drop below support at $0.3894 could trigger a stronger bearish trend, pushing the price down to $0.3744.

Is Worldcoin a good investment?

Worldcoin (WLD) shows some positive momentum, with potential for growth if it breaks through resistance at $0.3920. However, if the price falls below $0.3894, it could lead to short-term volatility and potential losses. Investors should monitor these key levels carefully, as a breakout above resistance could signal bullish movement. Long-term investments, however, should take into account broader market trends and proper risk management.

Why is the WLD Price down today

Worldcoin’s price is down due to broader market weakness, with a risk-off rotation away from altcoins and no specific coin-related catalyst. The near-term outlook hinges on holding support at $0.38, with potential for a recovery if Bitcoin stabilizes above $66,000, while further declines could target $0.35.

Recent news

Worldcoin is now active in over 100 countries with around 25 million users, including 12 million verified via Orbs. Developers are earning about $300K per month in WLD to create human-only apps, and rumors suggest major social platforms might adopt Orb-style ID soon.

Worldcoin has announced the release of its GKR prover for machine learning as an open-source tool, allowing users to run ML models on their devices and generate cryptographic proofs for each correct execution. This innovation enables use cases like local World ID upgrades, eliminating the need for Orb revisits and enhancing privacy, security, and trust.

Worldcoin has successfully finalized the Phase 2 Trusted Setup ceremony for its World ID protocol, marking a significant milestone in the development of its privacy-centric identity system. The ceremony, which involved over 100 contributors in generating cryptographic contributions, is crucial to the protocol’s next phase of implementation.

Will Worldcoin reach $5?

Yes, according to the long-term predictions, Worldcoin is projected to reach up to $5 by 2032.

Will Worldcoin reach $100?

Worldcoin’s prediction shows that $100 is highly unlikely due to current market conditions, its present price levels, and the significant rise in market capitalization required, impacting worldcoin price movements. Such an increase would necessitate extraordinary growth and adoption.

Does Worldcoin have a promising long-term future?

The WLD coin is exhibiting a recovery trend; therefore, many may consider investing in the token, as it may have a promising long-term future and could be viewed as a good investment, despite the potential short-term risks. Continued development, adoption, and favorable market trends will be crucial for its success.

Worldcoin price prediction February 2026

Worldcoin is expected to exhibit a range of price movements in February 2026. The potential low is $0.398, while the average price might be around $0.4255. On the higher end, WLD could reach up to $0.4377.

| Month | Potential Low | Potential Average | Potential High |

| February | $0.398 | $0.4255 | $0.4377 |

Worldcoin Price Prediction 2026

By the end of 2026, Worldcoin is expected to trade at a minimum price of $0.352, which aligns with our price prediction reflecting its current market dynamics. WLD price can reach a maximum of $0.668, with the average price of $0.612.

| Year | Potential Low | Potential Average | Potential High |

| Worldcoin price prediction 2026 | $0.352 | $0.612 | $0.6686 |

Worldcoin Price Prediction 2027-2032

| Year | Minimum Price | Average Price | Maximum Price |

| 2027 | $0.8145 | $0.8385 | $1.00 |

| 2028 | $1.22 | $1.25 | $1.41 |

| 2029 | $1.74 | $1.79 | $2.15 |

| 2030 | $2.50 | $2.57 | $2.94 |

| 2031 | $3.57 | $3.70 | $4.27 |

| 2032 | $5.24 | $5.43 | $6.40 |

Worldcoin price prediction 2027

The price of Worldcoin is predicted to reach a minimum value of $0.8145 in 2027. The Worldcoin price could reach a maximum value of $1.00, with the average trading price of $0.8385.

Worldcoin price prediction 2028

Worldcoin price prediction continues to climb even higher into 2028. According to predictions, WLD’s price will range from $1.22 to $1.41, with an average price of $1.25.

Worldcoin price prediction 2029

According to the Worldcoin price prediction for 2029, WLD is expected to reach a minimum level of $1.74. WLD has an average trading price of $1.79 and a maximum cost of approximately $2.15.

Worldcoin price prediction 2030

According to the Worldcoin price prediction for 2030, WLD’s price is expected to range between $2.50 and $2.94, with an average of $2.57.

Worldcoin price prediction 2031

The highest price for 2031 is $4.27. It will reach a minimum price of $3.57 and an average price of $3.70.

Worldcoin price prediction 2032

According to the 2032 Worldcoin price prediction, the price is expected to range between $5.24 and $6.40, with an average price of $5.43.

Cryptopolitan’s Worldcoin price forecast

According to Cryptopolitan, Worldcoin (WLD) is expected to experience growth in 2026, as it has the potential to achieve new highs in terms of price points and market capitalization. By the end of 2032, Worldcoin’s price is expected to recapture and surpass the $6 mark.

Market price prediction: Analysts’ Worldcoin forecast

| Firm | 2026 | 2027 |

| DigitalCoinPrice | $1.49 | $1.9 |

| Coincodex | $0.582 | $1.27 |

Worldcoin’s historic price sentiment

Worldcoin Price History: Coinmarketcap

- Worldcoin hit a low of $0.9758 on September 13, 2023, and reached an all-time high of $4.70 on December 17, 2023. Between December 31, 2023, and January 30, 2024, its price fluctuated significantly, opening at $3.70 and closing at $2.47, with a high of $3.18 and a low of $2.09, representing a 35.71% decrease.

- In March 2024, WLD surged to over $10 but quickly fell below $5 by April. From June to August 2024, it traded within the range of $1.64 to $4.10, reflecting ongoing volatility in its value. In October 2024, it peaked at $2.650 but dipped afterward.

- In December 2024, the WLD price traded between $3.76 and $4.00.

- In January, the WLD price hovered around $2.3.

- In February 2025, Worldcoin traded between the range of $1.00 and $1.60

- In March 2025, the asset’s price fluctuated between approximately $1.18 and $1.25, experiencing an initial rise, followed by a sharp peak, a subsequent decline, partial recovery, and another drop to around $1.17.

- In April 2025, Worldcoin started trading around $0.76 and experienced a significant surge toward the end of the month, peaking at over $1.20.

- By early May, the price had corrected slightly and settled around $0.95. It touched a high of $1.6 but later declined due to rising selling pressure by the end of May.

- In June, WLD declined steadily from around $1.12 to $0.87, marking a monthly drop of approximately 22%.

- In July 2025, Worldcoin started trading within a range of $0.860 to $0.9026.

- The price of Worldcoin (WLD) in August 2025 is approximately $0.99.

- In September 2025, Worldcoin began trading within a range of $0.85 to $ 0.90.

- Worldcoin (WLD) traded between approximately $0.84 and $0.88 from late October into early November, showing brief upward momentum before dipping below $0.86.

- Worldcoin (WLD) traded near its monthly low of about $0.57 at the start of December 2025 before rebounding to roughly $0.63 later in the month.

- In January 2026, Worldcoin traded in a narrow range around $0.58–$0.61, showing brief rallies toward $0.61 followed by pullbacks, and ended the period hovering near $0.59 with modest volatility.

- As of February 2026, Worldcoin (WLD) has shown short-term volatility, trading between approximately $0.399 and $0.411.